Some motorists want to pay a bit more for outstanding client service, some want the most affordable rates, while others prefer carriers who can deal with claims and payments through mobile apps, some prefer representatives. Determining finest cars and truck insurance in California, To recognize the, we evaluated top carriers in the state and ranked them on claims, customer complete satisfaction, monetary strength, online shopping and cost.Car, Insurance coverage.

Power asked consumers about client satisfaction and digital shopping experiences. A.M. Best financial rankings show a business's capability to fulfill its financial obligations. That means an insurance provider with an A or above is going to be able to pay out a claim if you submit one. In the 2021 J.D.

Auto Insurance Coverage Research study, Wawanesa received leading rankings as the very best car insurance in California for customer fulfillment. Geico had the least expensive rates amongst the best insurance business in California surveyed for cars and truck insurance expenses, it had the greatest problem ratio. State Farm was the most pricey, however had the most affordable problem ratio and excelled in claims managing and online shopping experience.

Power, and made a 4 for claims managing. Geico Deal hunters, as it has the most affordable rates general for motorists in California, and is also most affordable for chauffeurs with tickets and mishaps as well as senior vehicle drivers. Though it got a 4 ranking from Vehicle, Insurance. com for claims and placed 4th in J.D.

Power's rankings but made high marks (4 out of 4) for claims managing from Automobile, Insurance coverage. com. State Farm Young drivers, teen chauffeurs and student chauffeurs and those looking for special protections and a terrific online shopping experience. State Farm had the most affordable grumble ratio on the best list, the greatest rating for claims and likewise ranked well for online shopping and client fulfillment.

Car Insurance - Get An Auto Insurance Quote - Allstate for Beginners

USAA had the greatest J.D. Power customer complete satisfaction score in the country (880) and likewise topped the list of finest insurers in Automobile, Insurance coverage. Military members can take benefit of specialized protection options around release and storage, while likewise getting discounts for low-mileage.

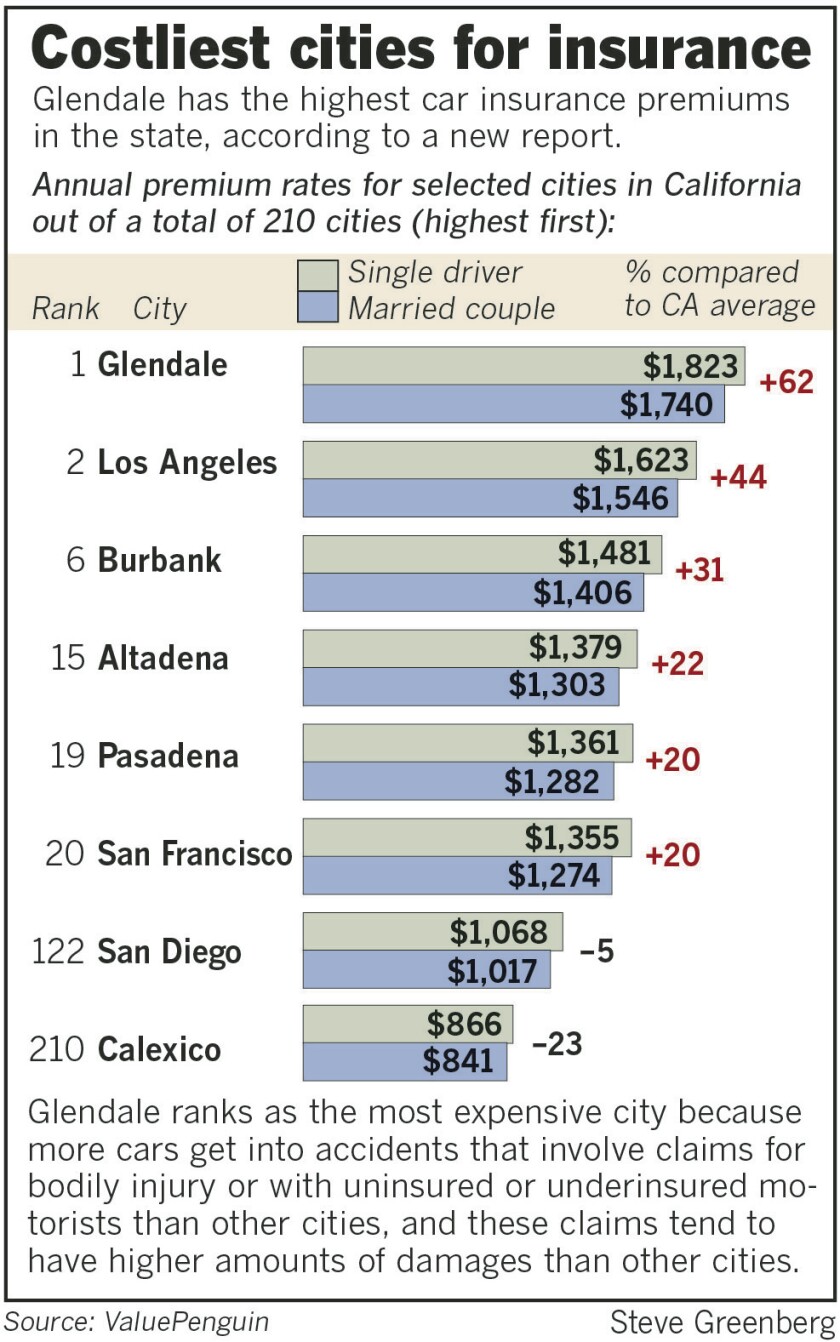

Your age, your driving record, the design of car you have, the seriousness and frequency of claims in your community and other variables are used by business to determine the expense of your policy. That's why the rate for the very same protection can vary significantly amongst insurance companies and why you should compare rates.

Taking full advantage of discounts, for example bundling your home and automobile with the exact same business can save up to 12% on your automobile expenses. Dropping comprehensive and crash for vehicles that are worth less than $3,000 Treking your deductible quantity, for example, from $500 to $1,000 ZIP code, Fundamental personal details name, age, birthday, Driving history, Present insurer, Info on other drivers in your home, Car make and design, Preferred coverage types, limitations, and deductibles, All lorries VIN (vehicle recognition number)If you own, rent or finance your automobile, Annual mileage, All home motorist's license numbers, Amount of time you have actually been guaranteed, Once you provide the information, you will usually get a quote that is in many cases a quote of what you will pay.

The Basic Principles Of 15 Tips And Ideas For Cutting Car Insurance Costs - Investopedia

To drive lawfully, you need to purchase least the minimum coverage required by state laws, which implies simply liability insurance coverage that pays for others' injuries and damage you cause. If you didn't borrow cash from a lender to buy your automobile and you do not have a lot of money or assets to safeguard, that may be a wise choice.

Additionally, if you have a home and savings to protect, it's a good idea to purchase more coverage. Liability Protection, The more money and possessions you have, the most likely it is that you might be taken legal action against following a car mishap. Unless you are determined to pay the most affordable vehicle insurance rate possible, we advise you purchase greater than minimum liability protection.

Space insurance, If you got a loan to spend for your car and have a mishap, gap insurance coverage pays the difference in between the money worth of your cars and truck and the present impressive balance on your loan or lease. your vehicle is less than one year old and you've put less than 20 percent down on it, you need to purchase gap insurance.

Average Car Insurance Cost In California: What You Should ... Things To Know Before You Get This

Vehicle, Insurance coverage. You can get average rates by ZIP code, and listed below you can see how much it costs, on average, to insure a particular make and design lorry in California.

3 methods to save money on vehicle insurance in California, Here are crucial methods California drivers can save money and get cheap vehicle insurance coverage premiums. Compare quotes, A minimum of as soon as a year upon renewal, compare quotes for the similar protection from a minimum of 3 automobile insurance coverage business. Required help remembering? Download our mobile insurance coverage pointer app.

Your driving record and years certified, amongst other elements, are also considered when companies set your rates, but in California your credit report is not. Pay-per-mile plans, such as City, Mile, are one option the less you drive, the less you pay. Usage-based plans, such as Progressive's Photo or State Farm's Drive Safe & Save can earn you a discount if your driving routines prove to be safe.

Not known Details About Car Insurance In California

Safe chauffeur discount rate, State law mandates that you get a 20% discount if you have a tidy driving record and have actually been licensed for 3 years. Fully grown motorist discount, If you are age 55 or older and effectively complete an authorized protective driver course, your insurance coverage business should give you a discount, typically 5% to 15%, for three years.